THINK

Really think about what's important

PLAN

Develop a plan to get what you want

ACT

Take action and achieve your goals

WHAT’S YOUR MONEY STORY?

We all have our own story and relationship with money but at the end of the day, there are only three situations; you either don’t have enough, you have too much or you have just the right amount.

Not enough

There are two types of people who don’t have enough money. Some people don’t have enough to live the life they want now. Others are not building enough wealth to maintain their lifestyle in the future.

If you don’t have enough money to live the life you want, now or without the fear of running out of cash then the sooner you find out the better. When you know your number you can start working on your business to improve your position.

Too much

People who have more money than they need to live the rest of their life, without the fear of running out of cash, need to know what the surplus is. When they understand this they can create spending/giving plans as well as thinking about creating a legacy. And, they never need to feel guilty about spending money ever again.

Don’t make the mistake of being the richest person in the graveyard.

Just right

Many people who have just the right amount of money to live the rest of their life without the fear of running out of cash don’t know it. As a result, they can take more risk than they need to, have complicated financial arrangements, feel guilty about spending money and not live life as fully as they could.

When you know you are “just right” you will have peace of mind and the feeling of financial security.

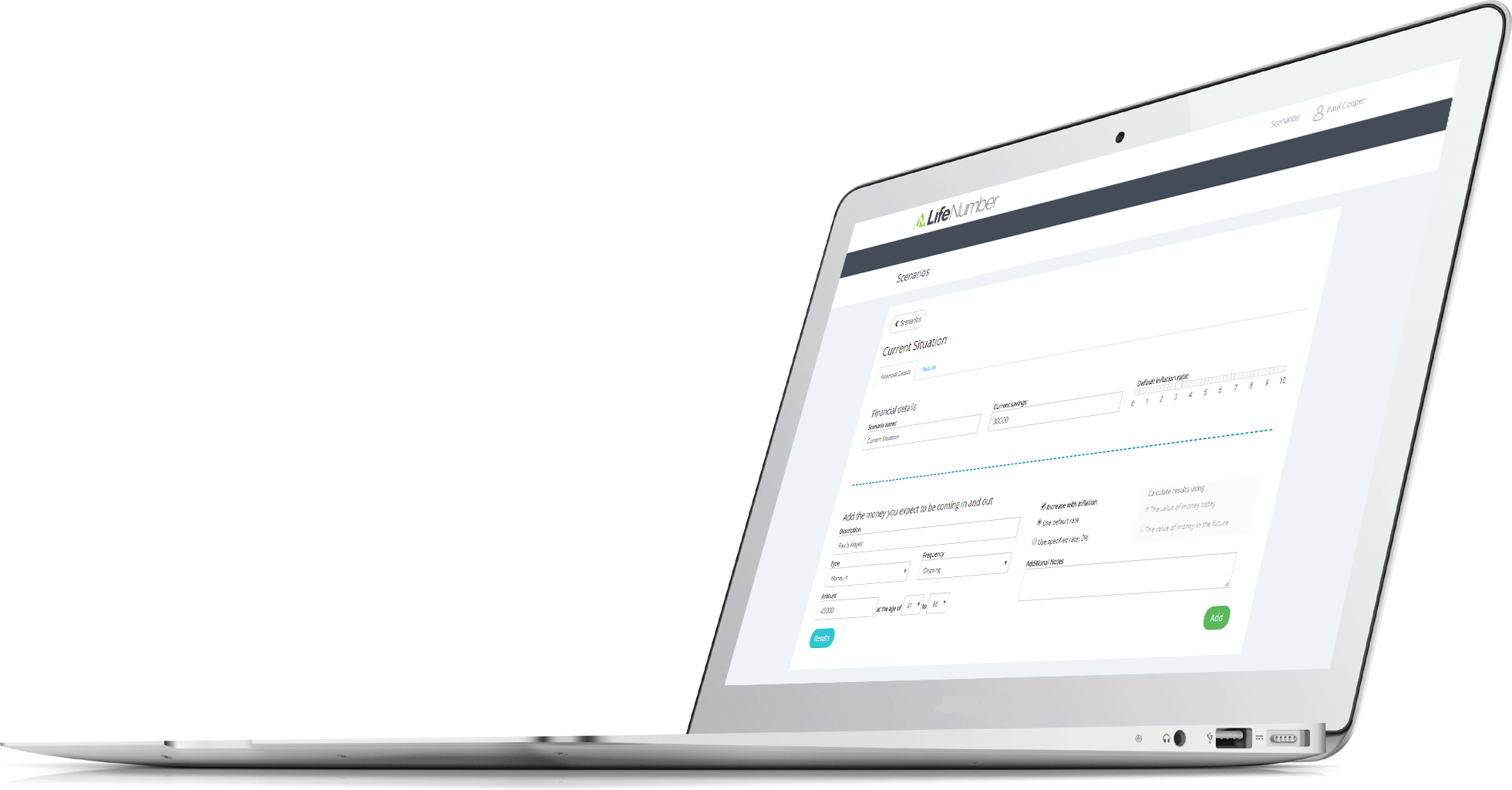

IT’S AS EASY AS ONE, TWO, THREE

Step 1 – Add your incomings

Simply add your incoming; these can be yearly inflows or one-offs such as a pension lump sum, downsizing your home or an inheritance.

Enter the amount, and whether you want it to increase with inflation. It’s as simple as that.

Step 2 – Add your outgoings

Add your outgoings in the same way as you would your income. These can also be yearly or one-offs like gifts and major purchases.

Enter the amount and if you want it to increase with inflation and you’re done.

Step 3 – See your results

LifeNumber will produce a graph so you can see a ‘Not enough’ a ‘Too much’ or a ‘Just right’?

You can run as many scenarios as you want with different assumptions and plans. When you are happy with your plan you can take the action necessary to achieve your goals.

We’ve developed a short story to highlight how powerful LifeNumber can be. To read about Nigel Holland click here.